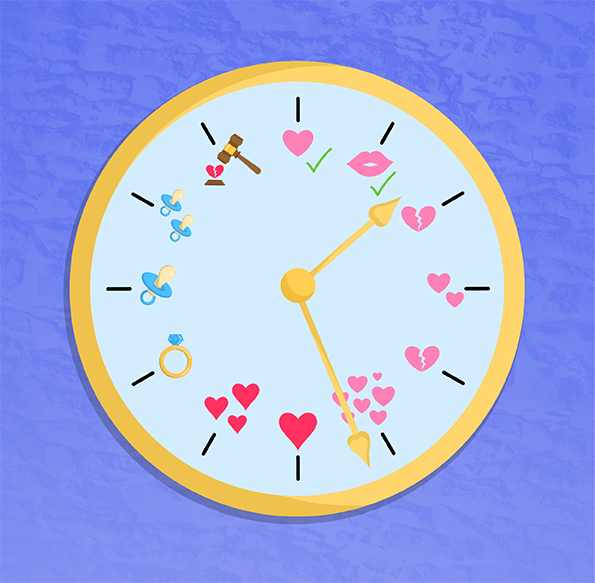

A growing number of young adults are yearning to take an alternative route–a shortcut–toward their economic freedom and autonomy. As members of the Financial Independence, Retire Early (FIRE) movement, individuals aspire to accumulate enough wealth to retire between the ages of 30 and 50.

Perhaps differing from a social or political movement, FIRE is a personal financial strategy in the form of a lifestyle. The method is two-fold:

- Calculate how much is needed to have saved in order to maintain a living; this amount is usually 30 times your yearly expenses.

- Dedicate 70% of your income to savings. When your savings reach your desired amount, you may quit your job and retire.

Given the additional benefits of the liberation from Monday blues and stressful relationships with your boss, you might be compelled to join as well. However, the FIRE movement might actually do more harm than good.

First and foremost, we must question a fundamental aspect of early retirement: its feasibility. FIRE can be a viable financial strategy for some but is not the case for many. For example, high school and university students willing to retire early would start making an effort towards doing so. But realistically, how can students save money from jobs they can not even dedicate all their time to?

In the case of a college student, one would have to manage the workload of school and part-time jobs simultaneously. A senior undergraduate at NYU shared that she allocates an additional 18 hours per week to complete homework and assignments outside of class.

“I have a tough time taking up shifts in my one current job — but that could also be because I enjoy hanging out with people (online and in-person) outside of school.”

She hence concluded that retiring before reaching the age of 30 would be “absolutely [impossible].” As appealing as early retirement is, the FIRE movement deceives young adults into thinking that joining the movement is a crucial step to being an adult. Nevertheless, trying to belong in the adult world through early financial independence would, in fact, be both impractical and exhausting.

Another aspect of the FIRE movement that makes it an absurd idea to join is that life after achieving financial independence causes emotional ambivalence. While gaining wealth is a source of motivation for many to start and grow their ventures, studies indicate that post-financial freedom does not grant as much happiness as one might have wished for.

As a matter of fact, research by professors of Institut Européen d’Administration des Affaires, a business school headquartered in France, shows that the seemingly limitless possibilities that lie ahead after retirement actually induce anxiety. They concluded that attaining financial freedom does not automatically translate to a fulfilled life, even for the most successful entrepreneurs.

This may be similar to the change in attitude of high school students towards summer holiday. Given the heavy workload throughout the entire school year, students long for the summer break. Yet when the time actually comes, how long does this indulgence of vacation freedom usually last? Most probably a mere week or so. Such dissatisfaction with “freedom” is due to a lack of motivation, purpose, and direction: all of which are integrated not only in school but also in the workforce.

Finally, the last reason why one should not join the FIRE movement is that early retirement is a source of discouragement, not encouragement. While aiming for early retirement provokes one to work harder in the short term, the FIRE movement actually stunts the overall development of the workforce in the long term.

If this is because the greater the number of people willing to retire early, the larger the population of those with their minds engraved that the definition of accomplishment in life as expedited retirement. Instead of dreaming to reach one’s own expertise, the world would only care about money, money, and money. In this case, society would be quick to lose talented, skilled people with decent jobs and positions.

At the end of the day, financial success never means success in life. As stated in the book Your Money or Your Life by Joseph R. Dominguez and Vicki Robin, “waste lies not in the number of possessions but in the failure to enjoy them.” If your only dream is to make money, what other dreams would be left on sale for you to buy?